If you are a freelancer or contracter in the UK, it’s important to know if you fall under the IR35 legislation. This legislation was put in place to stop “disguised employees” — that is, workers who are invoicing companies but working as if they are employees. The legislation has been quite a grey area in the past, but guidance has been recently published which helps to clarify the levels of risk.

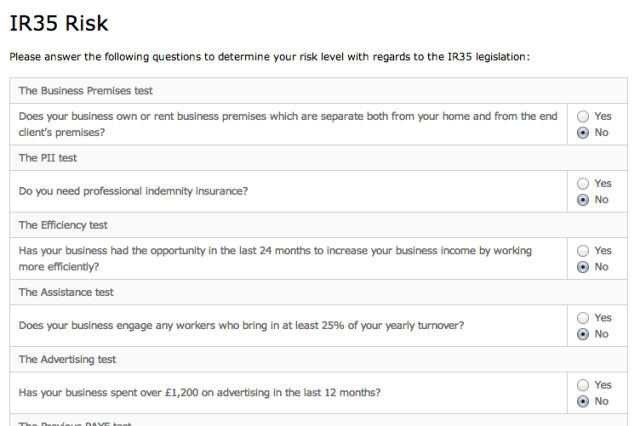

Using this guidance, I’ve put together a tool which asks a series of questions and then rates you as either low, medium or high risk.

You can find the tool at ir35risk.co.uk

Even with this tool, I would recommend speaking with an accountant if you have any concerns about whether you are at risk.